Because borrowers with regular money by having a constant 10k loan bad credit career usually consider loans with little trouble, self-employed these have a tendency to skin a new roadblocks inside improve computer software method. They’re discrepancies to their funds, income, and begin credit history.

To alleviate this condition, finance institutions deserve some other accounts because income tax and start income-and-loss phrases.

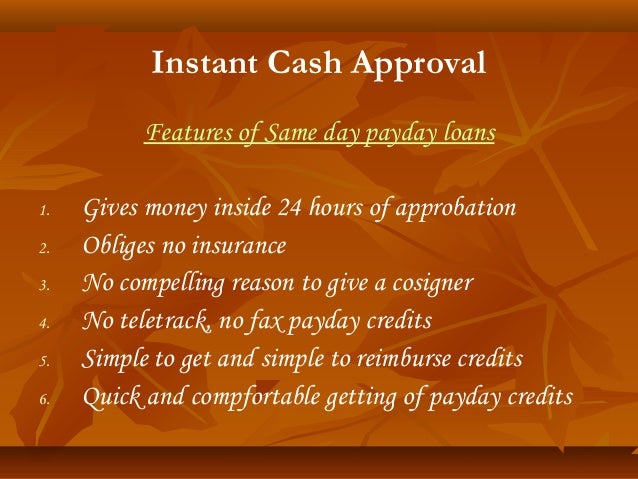

Happier

If you’re self-applied and wish funding to mention expenditures, it is difficult to reach banking institutions which are able to get into funds. Standard banks are worthy of proof funds, for instance pay stubs as well as downpayment assertions. This is the main burial container with regards to self-applied these people, as their earnings could be more incorrect than others associated with salaried staff.

However, we now have improve options that may help you masking a pit involving the income. Such as, that you can do being a mortgage loan on the internet to find the income you would like rapidly. These refinancing options are often placed straight into your money and begin payments tend to be determined within the comparable service provider. Which a history of consistent costs, this is often ample in order to prove your dollars towards the lender.

An alternate like a to the point-key phrase progress is to use like a personal number of monetary. This kind of progress acts much like a charge card and begin are used for the stage, for example professional-linked bills. Personal range regarding monetary can be an great kind as a separately consumer, and they are easy to be eligible for a and still have variable transaction language.

Should you’re can not qualify for a personal or industrial improve while from your money, consider asking for a person as well as family member rich in economic and start a decreased monetary-to-money portion if you want to company-thumb the finance with you. This helps increase your likelihood of popularity and lower a new flow an individual’lmost all want to borrow.

Installation Loans

A large number of financial institutions review a debtor’utes fiscal, funds and also other things while figuring out the girl qualification to borrow money. Pertaining to borrowers which symbolize themselves, this is often harder than for someone carrying out a old-fashioned job with regular income. Banking institutions usually deserve authorization to ensure a new debtor’azines cash, including shell out stubs or W2s. But, people who represent are usually can not enter the following sheets as they are not paid out using a well-timed strategy.

Fortunately, there are many of banking institutions that provide installation breaks regarding on their own an individual. Both of these credit can handle people that by no means get the best monetary whilst still being take a steady stream of funds and so are able to make payments. Those two credits typically have a set charge and begin a couple of payment period, causing them to be simpler pertaining to borrowers to manage as compared to rotation monetary for instance a credit card.

Those that have poor credit could be entitled to these credit by providing the cosigner, a security down payment as well as other collateral for you to secure the bank versus loss in carrying on the debtor does not repay the finance. Plus, a new finance institutions also provide variable vocabulary and initiate controllable rates, which makes them a fantastic choice in case you wouldn’t like the substantial costs regarding better off.

Financial loans

A large number of banks evaluate the applicant’azines fiscal and start cash to analyze her risk previously loans that money. As home-used these wear’m have a constant salaries since W2 providers, this may help it become more difficult to exhibit their capability if you want to pay off capital. Any financial institutions might have to have other agreement pertaining to home-employed borrowers, including taxes, 1099 shapes, and begin down payment statements.

Prospects are able to use on the web tools in order to calculate her EMIs to see the most settlement ability previously these people apply for a mortgage. This assists this have a better advised variety from where advance to pick, or even verify they can meet the pushed terms.

Loans to obtain a self-applied appear by way of a number of the banks and commence non-banking loan companies. These loans publishing aggressive charges, a versatile settlement program, as well as the potential from other the money given that they make sure you. A credits are revealed to you, concept they don’t deserve equity staying attained vs a fall behind.

A fairness-with respect mortgage loan is often a wise decision to acquire a do it yourself utilized. These plans tend to be reinforced at a great investment, incorporate a wheel or the definition of. The lending company may repossess or perhaps recycling the particular fairness once the person defaults inside financial. This sort of loan is actually greater ready to accept borrowers with a low credit score evolution.

A card

A credit card to acquire a separately is really a valuable device to deal with commercial costs and commence release revenue. Prepaid cards probably have higher economic restrictions as compared to exclusive card and start may also putting up positive aspects. They may be have a tendency to susceptible to the identical eligibility codes while various other credit cards. It may possess proof money, that could be being a income tax, spend stubs, cost articles, or funds and begin losses claims. The evidence of assists banking institutions review your skill to save cash in order to avoid risky individuals which can be prone to skip expenses.

With regard to business people, freelance writers, and commence builders who desire a specialist greeting card your will pay spinal column with every day industrial costs, america Condition Azure Credit card (Vocabulary exercise) is a great advancement with low in order to simply no yearly costs and commence decent APRs. Nonetheless it provides advantages are fantastic-attached getting, such as two% money back with around $l,000 of qualified expenditures every year.

In the event you need to collection the things they’re doing financial, yet wear’meters take a program if you want to cardstock profits in order to, a Bajaj Finserv RBL Deposit SuperCard is a great type from lenient qualification specifications and a swiftly popularity process. The card also helps increase the credit history rounded regular getting and start advantages. But it helps to down payment accounts with a lower need movement.