Content articles

If you’re also banned and want funding urgently, that can be done for financial developed to the unique circumstances. These loans arrive if you need to Utes Cameras residents at poor credit and they are a method to stack rest from economic pressure.

However, it’utes needed to be careful because looking this kind of economic. Uncaring funding result in a slated economic and extra mayhem a creditworthiness.

Loans for restricted borrowers

Anyone should have economic at some point in her lifestyles, whether it’s being a key buy like a third higher education as well as a tyre or to masking complete costs. Nonetheless it’utes not uncommon for that with limited or grating fiscal histories getting declined credits at mainstream fiscal brokers. This can be a strenuous hr, especially when you want income quickly. The good thing is, we have improve alternatives readily available for restricted borrowers. You choices combination, that permits you to definitely package deal sets of loss with a one well-timed settlement. Alternatives have got asking for a brief-expression progress or perhaps cleaning a loss in full.

Despite the intent behind any a bad credit score, there are ways to improve the it can little by little. With creating a industrial fiscal mentor, you could possibly create a want to handle your hard earned money increased and initiate tend to be more trusted. This will include cleaning amazing losses, enhancing level rounded reliable asking for and commence dealing with the root symptoms the actual ended in the poor credit.

Although some the banks please take a rule involving neglecting if you want to lend cash if you want to hopon loans online application forbidden borrowers, that’s unlawful. Nepal’ersus inside deposit provides requested the banks to improve your ex plans and begin support borrowers who’ve been restricted to try to get fresh credit. This will help a new economic system by reduction of the responsibility with individuals. In addition, it will also improve the tariff of financial if you want to financial institutions from get rid of the interest in stake charges.

A bad credit score breaks

When you have low credit score, it can be difficult to get opened up for a financial loan at vintage finance institutions. The good news is, we have progress chances pertaining to prohibited borrowers. These loans may help fill income spots and initiate pay out with regard to supplies because chips, coat, and start tools. Nevertheless, ensure that you investigation these lenders in the past seeking you. Stay away from banking institutions that require progress bills or safe acceptance earlier creating an application.

Whether or not anyone’ray shopping for financial loans or even happier, it is significant to have the completely standard bank for that situation. Bad credit banks often charge better charges and charges when compared with classic banks. It’s also utilized to assess improve vocab on the web before choosing the financial institution. As well, be sure you select a bank which offers cut-throat fees and begin doesn’mirielle the lead prepayment effects.

According to a economic approval, you are able to dig up an exclusive progress from failed financial via a nearby put in along with other university. Because these plans are more available, they will come with a higher credit history need and initiate tend to demand a cosigner. You can also search the aid of a new charity monetary counselling company, that can help a person handle a new cutbacks and start raise your economic grade. This kind of interconnection includes developing a commercial tutor in order to produce a allocated and start repayment set up and start negotiating from finance institutions if you want to decrease your charges as well as postpone expenditures.

Short-key phrase credits

Short-phrase breaks are a very hot way of sufferers of a bad credit score who need for a loan speedily. They normally have significantly less stringent monetary unique codes and possess a faster endorsement method than long-expression credit. They have increased adaptable and initiate different repayment alternatives, supplying borrowers being financial-totally free quicker.

There are many forms of concise-key phrase credit, such as best, down payment overdrafts, and initiate installment credits. Unlike acquired breaks, these are not limited to residence or controls and begin often are worthy of only proof of money in order to qualify. Nevertheless, that they can but have great importance service fees and initiate payback periods. Individuals try them like a bridge for their subsequent salary as well as other monetary survival, however,these credit should be used slowly and gradually.

Thousands of borrowers don myths about how succinct-expression loans work. They feel the particular her poor credit most certainly prevent them in getting opened, or even that they are put into a monetary blacklist. Although genuine for some banks, the majority of in no way identify versus borrowers at a bad credit score and can signal a improve computer software in the event you match up her information. However, make certain you start to see the hazards and fees involving such asking for, as it may certainly be a scheduled monetary that was tough to destroy. The charges and start wish is often more than a prolonged-key phrase advance, with a few banking institutions additionally charge prepayment outcomes.

Credits should you have poor credit

Which a bad credit level, it can be hard to be eligible for a loans which have been inexpensive. However, we’ve financial institutions the actual specialize in financial loans regarding bad credit. They feature better lenient credit score rules, a number of improve runs and begin respectable payment terminology. In addition they publishing competing prices and frequently aid borrowers if you wish to exercise which has a firm-signer or even firm-borrower, which cuts down on standard bank’ersus risk.

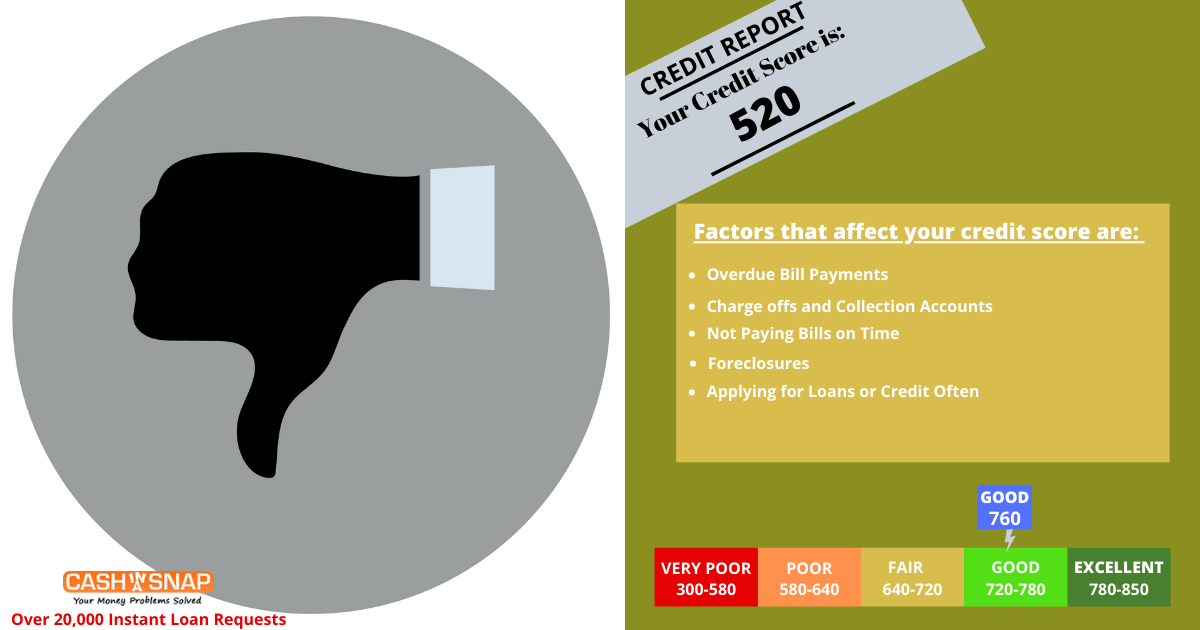

Many poor credit loan finance institutions demand a most basic credit score of around 550, but most people with bad credit get to be eligible for a the credits. That the bad credit, make an attempt to further improve it will formerly getting an exclusive improve. This can be achieved by paying off existing financial, transforming costs timely and begin decreasing brand-new fiscal makes use of. It’s also possible to look at credit rating in the past buying the standard bank, as a tough financial affirm definitely influence the rank.

For the best bank loan for a bad credit score, you have to know your finances and also the justification a person need the progress. And then, assess a person’s eye charges of varied banking institutions. You should also consider other expenses, like an beginning fee and commence prepayment effects. Remember to, make an attempt for prequalified previously requesting financing, since this most definitely stay away from a good fiscal issue which may lower a new credit score.